What Is Ground Rent? A Complete Guide for Homebuyers

Ground rent represents one of the most misunderstood aspects of leasehold property ownership, creating ongoing financial obligations that many homebuyers fail to fully comprehend before purchase completion. This annual charge paid by leaseholders to freeholders creates legal obligations that continue throughout lease periods whilst potentially affecting property values, mortgage availability, and future sale prospects. Understanding ground rent implications becomes crucial for making informed purchasing decisions that avoid costly surprises or restrictions that might affect long-term homeownership satisfaction.

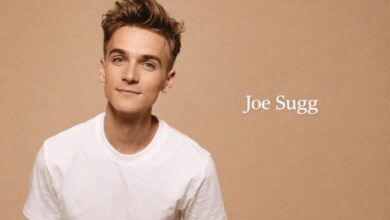

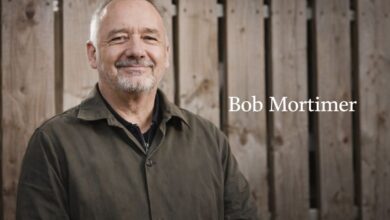

The complexity surrounding ground rent extends beyond simple annual charges to encompass escalation clauses, collection procedures, and potential consequences for non-payment that can seriously impact leasehold ownership experience. Farnborough estate agents frequently encounter buyers who require a comprehensive ground rent explanation to understand fully the implications of leasehold purchase decisions and ongoing financial commitments.

Understanding Ground Rent Fundamentals:

Ground rent represents an annual payment obligation from leaseholders to freeholders that acknowledges the underlying land ownership whilst providing freeholders with ongoing income from property development investments. This payment system originated from historical land tenure arrangements where property developers retained land ownership whilst selling long-term occupation rights to individual homeowners.

Legal framework governing ground rent involves complex legislation including lease terms, statutory provisions, and recent reforms that affect payment obligations, escalation procedures, and enforcement mechanisms that vary significantly between different leases and property types requiring careful individual assessment.

Payment frequency typically involves annual charges, though some leases specify half-yearly or quarterly payments with specific due dates and collection procedures that create ongoing administrative obligations for leaseholders throughout ownership periods.

Default consequences for non-payment can prove severe, potentially including forfeiture proceedings where freeholders might reclaim properties for unpaid ground rent arrears, making understanding of payment obligations and collection procedures crucial for protecting leasehold ownership rights.

Recent legislative changes including ground rent restrictions for new leases and ongoing reforms affecting existing arrangements, create an evolving landscape that requires a current understanding of applicable rules and future obligation changes.

Ground Rent Amounts and Escalation Mechanisms:

Initial ground rent amounts vary dramatically between properties and lease terms, ranging from nominal peppercorn rents to substantial annual charges that can reach hundreds or thousands of pounds depending on property value, location, and lease negotiation circumstances.

Escalation clauses within leases determine how ground rent increases over time through various mechanisms including fixed increases, inflation adjustments, rent review procedures, or doubling provisions that can create substantial future payment obligations beyond initial affordable levels.

Doubling clauses represent particularly problematic escalation mechanisms where ground rent doubles at specified intervals, potentially creating exponentially increasing obligations that may become unaffordable whilst affecting property mortgageability and sale prospects through onerous payment requirements.

Review mechanisms enable periodic ground rent reassessment based on property values, market conditions, or predetermined formulas that can result in significant increases during review periods, particularly when property values have appreciated substantially since lease commencement.

Calculation methods for increases vary between leases, with some using retail price index adjustments whilst others employ property value percentages or fixed monetary increases that create different financial impacts depending on economic conditions and property market performance.

Modern lease reforms have introduced restrictions on ground rent for new residential leases whilst existing leases continue under original terms, creating disparity between older and newer leasehold properties that affects comparative value and ongoing obligations.

Impact on Property Purchase and Ownership:

Mortgage availability can be affected by high ground rent levels or onerous escalation clauses that lenders consider when assessing lending risks and property security, potentially limiting financing options or affecting loan terms for properties with problematic ground rent arrangements.

Property values may reflect ground rent obligations through buyer discounting of properties with substantial or escalating ground rent liabilities that reduce net ownership benefits whilst increasing ongoing costs throughout ownership periods.

Purchase decision factors should include comprehensive ground rent analysis as part of overall ownership cost assessment that considers not just current payment levels but future escalation potential and long-term financial impact on property ownership viability.

Affordability calculations must incorporate ground rent alongside mortgage payments, service charges, and other ownership costs to ensure a realistic assessment of total accommodation expenses throughout projected ownership periods.

Legal advice becomes essential for understanding complex lease terms and ground rent provisions that might affect ownership enjoyment or create future financial challenges that could impact property ownership sustainability.

Recent Legislative Changes and Reforms:

Ground Rent Act 2022 restricts ground rent to peppercorn amounts for most new residential leases whilst providing some relief for existing leaseholders through limitation of charges and improved transparency that reduces future ground rent burdens.

Existing lease protection varies significantly, with older leases continuing under original terms whilst some provisions may benefit from new legislative protections that limit collection procedures or provide dispute resolution mechanisms.

Lease extension opportunities enable ground rent modification during formal lease extension procedures that can reduce or eliminate future ground rent obligations whilst extending lease terms and improving property security for long-term ownership.

Enfranchisement rights allow leaseholders to purchase freeholds individually or collectively, eliminating ground rent obligations whilst gaining control over property management and avoiding ongoing freeholder relationships that may become problematic.

Future reforms continue developing through government consultation and legislative proposals that may further restrict ground rent collection whilst providing additional protections for existing leaseholders against excessive charges or unfair practices.

Managing Ground Rent Obligations:

Payment procedures should be understood clearly including due dates, collection methods, and communication requirements that ensure compliance whilst avoiding penalties or default consequences that could affect property ownership rights.

Record keeping for ground rent payments provides evidence of compliance whilst protecting against incorrect demands or enforcement actions that might arise from payment disputes or administrative errors in freeholder record keeping.

Dispute resolution mechanisms including formal procedures and ombudsman services provide protection against unreasonable demands whilst ensuring fair treatment when ground rent disagreements arise between leaseholders and freeholders.

Professional advice from solicitors specialising in leasehold matters helps navigate complex ground rent issues whilst providing strategic guidance about lease modification, enfranchisement, or extension opportunities that might reduce future obligations.

Strategic Considerations for Buyers:

Due diligence requirements include a thorough ground rent investigation during property purchase procedures whilst understanding escalation mechanisms and future payment obligations that affect long-term ownership costs and property investment viability.

Alternative property consideration may be appropriate when ground rent obligations appear onerous, whilst freehold alternatives provide ownership without ongoing ground rent commitments that might prove more suitable for some buyer circumstances.

Negotiation opportunities during purchase may enable ground rent reduction discussion whilst lease modification possibilities could reduce future obligations through freeholder agreement and legal procedures.

Long-term planning should consider ground rent escalation alongside other ownership costs whilst evaluating whether leasehold purchase provides optimal value compared to alternatives that might better serve ownership objectives and financial planning.

Ground rent represents a significant leasehold ownership consideration that requires a comprehensive understanding before property purchase whilst ongoing management ensures compliance and strategic planning that optimises leasehold ownership outcomes through informed decision-making and professional guidance.