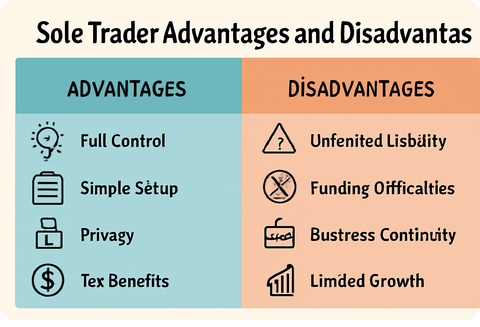

Sole Trader Advantages and Disadvantages

Understanding the Pros and Cons of Operating as a Sole Trader

Operating as a sole trader offers a straightforward approach to running a business, but it comes with its own set of challenges. Whether you’re considering starting a business on your own or already managing a sole proprietorship, it’s essential to weigh both the advantages and disadvantages. In this article, we’ll explore sole trader advantages and disadvantages, including financial aspects, liability concerns, and the flexibility this business structure provides.

What Is a Sole Trader Business Model?

Before diving into the advantages and disadvantages, it’s essential to define what a sole trader is. A sole trader is a person who owns and operates a business independently. They are responsible for all decisions, liabilities, and profits. Unlike a limited company, there is no distinction between the business and the owner legally. This structure is popular due to its simplicity and low startup costs.

Advantages of Being a Sole Trader

1. Sole Trader Benefits: Full Control and Flexibility

One of the main advantages of being a sole trader is the sole trader control and autonomy it provides. As the owner, you make all the decisions regarding your business operations, from pricing strategies to customer interactions. This flexibility allows you to quickly adapt to changing market conditions, unlike larger organizations that often require more time for approval and decision-making.

2. Simplicity and Low Costs

Sole trader simplicity is another major benefit. Setting up a sole trader business involves fewer administrative hurdles compared to starting a limited company. The sole trader registration process is straightforward, and there are fewer ongoing compliance requirements, such as submitting annual reports or undergoing audits. This makes it a cost-effective option for individuals starting their own businesses.

3. Sole Trader Privacy

Operating as a sole trader allows you to maintain a higher level of privacy compared to other business structures. Since the business and the individual are considered one entity, there is no requirement for public disclosure of financial records, giving you greater privacy. This can be advantageous if you prefer to keep your business affairs out of the public eye.

4. Sole Trader Tax Benefits

Another significant advantage is the sole trader tax benefits. Sole traders often enjoy simplified tax filing processes. Income from the business is reported on your personal tax return, and you may be able to claim business-related expenses, such as office supplies and travel costs, to reduce your taxable income. This ease of taxation makes managing finances straightforward for smaller businesses.

Disadvantages of Being a Sole Trader

1. Sole Trader Liability: Unlimited Personal Responsibility

One of the most significant sole trader risks is unlimited liability. Since there is no legal separation between the business and the individual, you are personally responsible for all debts and legal issues related to your business. If the business fails or faces legal action, your personal assets, such as your home or savings, could be at risk.

2. Challenges in Raising Capital

As a sole trader, it may be difficult to raise capital compared to a limited company. Lenders often view sole proprietorships as riskier, as there is no legal distinction between the business and the owner. This can lead to challenges in securing loans or investments. Sole trader funding difficulties can limit growth potential, especially if you want to expand quickly.

3. Business Continuity Issues

Another disadvantage of being a sole trader is the lack of continuity. Since the business depends entirely on the individual, if you become ill, unable to work, or decide to retire, the business may cease to operate. This can make sole trader business continuity issues more challenging to manage, especially for those planning for long-term stability.

4. Limited Growth Potential

While a sole trader can make all the decisions, scaling a sole trader business can be a challenge. The growth of the business is limited by your capacity to manage it on your own. Expanding the business might require hiring employees or transitioning to a different business structure, such as forming a limited company. This can introduce new complexities and responsibilities.

Managing Risks and Liabilities as a Sole Trader

1. Personal Asset Protection

To mitigate the risks of unlimited liability, many sole traders opt for business insurance for sole traders, including liability insurance. This helps protect personal assets in case of legal claims or financial issues. It’s also wise to conduct a risk assessment for sole traders to identify potential threats to your business and plan accordingly.

2. Legal Considerations

Sole traders should also be aware of legal implications for sole traders. For example, tax obligations and responsibilities vary depending on the region, so understanding your sole trader tax obligations and complying with them is crucial to avoid penalties. Consulting a tax professional can help ensure that your business stays compliant with local regulations.

Growth Challenges and Development as a Sole Trader

1. Business Expansion and Networking

When operating as a sole trader, scaling the business can be a challenge. However, focusing on business expansion strategies for sole traders can help you grow, even within this business structure. Networking and building strong relationships with clients and suppliers can provide valuable opportunities for growth. Additionally, consider delegation in sole trader businesses to ease the burden of managing all operations.

2. Marketing and Brand Building

As a sole trader, you are the face of the business. Personal branding for sole traders can be an effective way to establish a reputation and attract customers. However, this also means you’re responsible for all aspects of marketing and customer service. Striking the right balance between managing operations and engaging with clients is essential for success.

Operational Flexibility and Control for Sole Traders

1. Decision-Making Autonomy

Being a sole trader allows you to make quick, independent decisions. This operational flexibility is one of the most appealing aspects for many entrepreneurs. Whether it’s adjusting your services or responding to customer feedback, you have the authority to implement changes without delay.

2. Work-Life Balance

Since you have full control over your schedule, being a sole trader offers the potential for a better work-life balance. You can decide when to work, which allows you to structure your day around personal commitments. However, it also means that you are fully responsible for your workload, which can sometimes lead to long hours.

Frequently Asked Questions (FAQs)

What is the difference between a sole trader and a limited company?

A sole trader is an individual who owns and operates a business, while a limited company is a separate legal entity. Sole traders are personally responsible for business debts, whereas limited companies provide limited liability protection.

What are the tax benefits of being a sole trader?

Sole traders often benefit from simplified tax filing. Income is reported on your personal tax return, and business expenses can be deducted, potentially lowering your taxable income.

Can a sole trader hire employees?

Yes, sole traders can hire employees. However, they must comply with employment laws, including tax deductions, insurance, and health and safety regulations.

How do I protect myself as a sole trader?

Sole traders should consider obtaining business insurance to protect personal assets and manage risks. Consulting with an accountant or legal advisor can also help you navigate liabilities and ensure compliance with laws.

Conclusion

Being a sole trader offers both freedom and responsibility. The sole trader benefits, such as flexibility, autonomy, and tax simplicity, make it an attractive option for many entrepreneurs. However, the sole trader risks—especially the threat of unlimited liability and challenges in scaling—should not be overlooked. It’s crucial to weigh the advantages and disadvantages carefully and implement strategies to manage risks effectively.