Travis Perkins Share Price: A Comprehensive Outlook on Performance, Trends, and Market Position

Analyzing the fluctuations, financial health, and future prospects of one of the UK’s leading building material suppliers

Introduction

The Travis Perkins share price is under close watch from investors and analysts due to the company’s critical role in the UK construction sector and its recent financial volatility. Listed on the FTSE 250 and trading under the TPK.L ticker symbol, Travis Perkins plc is a prominent builders’ merchant and home improvement retailer headquartered in Northampton, UK. Founded in 1988, the company owns major brands such as Toolstation, BSS, Keyline, CCF, and Benchmarx.

In this article, we provide a deep dive into the current state of the TPK stock price, including key financial indicators, analyst insights, recent corporate developments, and how Travis Perkins compares with other industry players. This is your go-to guide for evaluating the company’s investment potential based on real-time data, performance metrics, and strategic direction.

Travis Perkins Share Price Overview

Recent Performance and Current Price Action

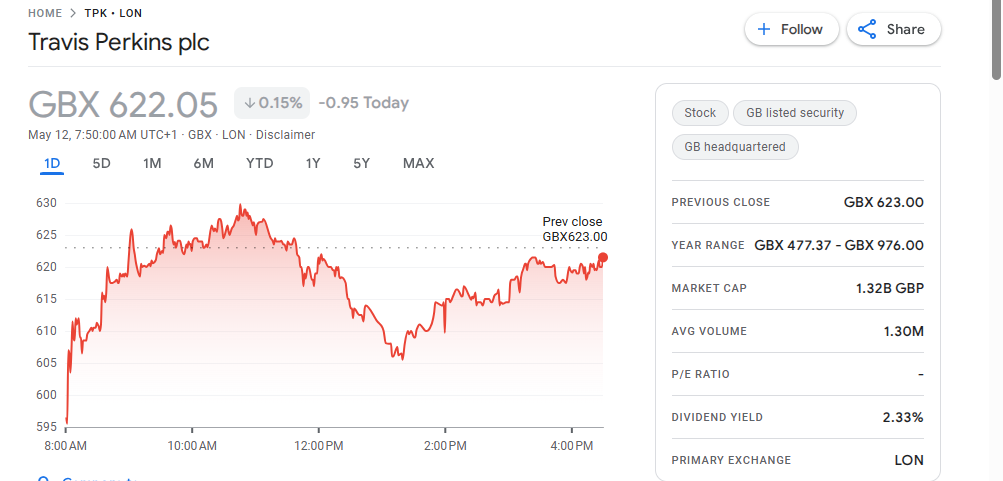

As of the latest market update, the Travis Perkins share price stands at 622.05 GBX, remaining flat after a previous surge. The stock has had a turbulent year, fluctuating within a 52-week range of GBX 477.37 – GBX 976.00. These numbers underscore the high volatility and reflect broader pressures in the UK housing and construction markets.

Market Capitalization and Trading Metrics

-

Market Capitalization: £1.32 billion

-

P/E Ratio: 17.02

-

Dividend Yield: 2.33%

-

Beta Coefficient: 1.99

-

Adjusted EPS (2024): 36.6p

These figures highlight the moderate valuation of Travis Perkins within its industry, with a relatively high beta coefficient suggesting elevated price sensitivity compared to the broader market.

Financial Metrics & Performance

Profitability and Growth Indicators

Travis Perkins has experienced a steep decline in operating profit, falling by over 99% in 2024 due to challenging macroeconomic conditions. This has raised concerns about the company’s dividend sustainability and future profitability.

-

Net Profit: In sharp decline

-

EBITDA: Contracting due to operational inefficiencies

-

Free Cash Flow: Under pressure

-

Turnover and Revenue: Sluggish, reflecting reduced construction activity

-

Return on Capital Employed (ROCE): Weakening

Liquidity and Balance Sheet Health

-

Debt-to-Equity Ratio: Elevated, indicating increased reliance on debt financing

-

Current Ratio & Quick Ratio: Closely monitored for short-term liquidity

-

Tangible Book Value per Share: Shows asset-backed value for shareholders

Company Overview: Travis Perkins PLC

Leadership and Corporate Structure

The company has recently undergone a leadership change, with Gavin Slark taking over as CEO from Pete Redfern. This transition comes at a pivotal time, as Travis Perkins seeks to navigate operational challenges and reposition its strategy in response to market downturns. Geoff Drabble serves as the Chairman, guiding the firm through its restructuring phase.

Business Segments and Brands

-

Toolstation: One of the fastest-growing DIY and trade counters

-

BSS, Keyline, CCF: Major players in plumbing, drainage, and insulation supply

-

Benchmarx: Kitchen solutions targeting homebuilders and contractors

The closure of Toolstation France marks a strategic pullback from underperforming international markets, allowing the company to refocus on its core UK business.

Investment & Analyst Insights

Analyst Ratings and Market Sentiment

Analysts have mixed views on the TPK stock price, with most maintaining a “Hold” rating. While the recent dip might represent a value opportunity, concerns about earnings volatility and dividend cover persist.

-

Target Price: Widely revised down across brokerage reports

-

PEG Ratio: High, indicating premium valuation versus growth

-

Payout Ratio: Rising, potentially unsustainable

-

Fair Value Estimate: Trading near or below estimated intrinsic value

Technical Indicators

-

Moving Averages: Currently below long-term averages

-

Relative Strength Index (RSI): Approaching oversold territory

-

Stock Rank & Momentum: Declining compared to sector peers

Recent News & Developments

Earnings Reports and Trading Statements

In its most recent earnings report, Travis Perkins posted disappointing results, with adjusted profits falling drastically. This triggered renewed investor concerns and prompted management to consider cost-cutting measures, including branch closures and sales force reduction.

Strategic Restructuring

Efforts are underway to streamline operations, reduce overhead, and improve cash generation. These include:

-

Digital transformation to improve supply chain efficiency

-

Closing underperforming segments

-

Reevaluating the merchanting business model

External Pressures

-

High interest rates and inflation impact have significantly affected the construction and housing sectors.

-

Economic slowdown across the UK has further dampened sales.

Related Companies & Competitive Landscape

Travis Perkins operates in a highly competitive environment. Key competitors include:

-

SIG plc

-

Grafton Group

-

Breedon Group

-

Howdens Joinery

-

Kingfisher plc (B&Q, Screwfix)

-

Jewson, Wickes Group, Selco Builders Warehouse, Wolseley UK

These companies are similarly exposed to construction trends and are evaluated on metrics like enterprise value to EBITDA (EV/EBITDA) and price-to-book ratio.

Future Outlook and Risk Factors

Key Catalysts for Share Price Recovery

-

Stronger-than-expected demand in the UK housing market

-

Stabilization of interest rates and economic conditions

-

Successful execution of cost control and restructuring plans

Risks to Consider

-

Further profit warnings or impairments

-

Market overreaction to economic data

-

Long-term strategic missteps or failure to innovate

Related Article Liontrust Asset Management Share Price:

FAQs About Travis Perkins Share Price

1. Why did the Travis Perkins share price fall recently?

A significant decline in profits, economic slowdown, and restructuring charges have negatively impacted investor sentiment.

2. Is Travis Perkins a good investment in 2025?

It depends on your risk tolerance. The stock shows potential upside if restructuring succeeds, but short-term risks remain high.

3. What brands are owned by Travis Perkins?

Toolstation, BSS, Keyline, Benchmarx, and CCF are among the company’s core brands.

4. What sector does Travis Perkins operate in?

Travis Perkins is a building materials supplier in the construction sector, closely linked to the UK housing market.

5. Who is the current CEO of Travis Perkins?

Gavin Slark, former CEO of SIG plc, assumed the role in 2025.

Conclusion

The Travis Perkins share price reflects the ongoing challenges and opportunities within the UK construction sector. While current financial metrics reveal a company under pressure, ongoing strategic changes and leadership restructuring may provide a platform for recovery. Investors should closely watch upcoming earnings, cost-saving measures, and macroeconomic trends to make informed decisions.