How to Calculate Business Rates: A Step-by-Step Guide to Understanding UK Non-Domestic Rates and Reducing Your Bill

The Complete Guide to Understanding and Managing UK Business Rates

Introduction to Business Rates

If you own or rent a commercial property in the UK, understanding how to calculate business rates is essential. Business rates, also known as non-domestic rates, are a type of tax charged on most non-residential properties. They are used to help pay for local council services.

Knowing how these rates are calculated can help you estimate your costs, identify possible savings, and avoid paying more than you should. This article will guide you through the entire process step by step.

What Is a Rateable Value?

The first step in calculating business rates is understanding the rateable value (RV) of your property. The rateable value is the estimated annual rent your property could earn on the open market. It is determined by the Valuation Office Agency (VOA).

Each rateable value is based on a specific date known as the Antecedent Valuation Date (AVD). For the current rating period, the AVD is 1 April 2021, as part of the Revaluation 2023.

You can check your property’s RV using the VOA property search tool.

Who Sets Business Rates?

Business rates are calculated by local councils based on the information provided by the VOA. The government sets a multiplier each year, and this is used to convert the rateable value into the amount of business rates you must pay.

The Business Rates Multiplier

The business rates multiplier is a number (in pence) per pound of rateable value. There are two types:

- Small business multiplier: For properties with a rateable value below £51,000.

- Standard multiplier: For properties with a rateable value of £51,000 or more.

As of the 2025/26 financial year:

- Small business multiplier: 49.9p

- Standard multiplier: 55.5p

These figures may change annually, so always check the latest values.

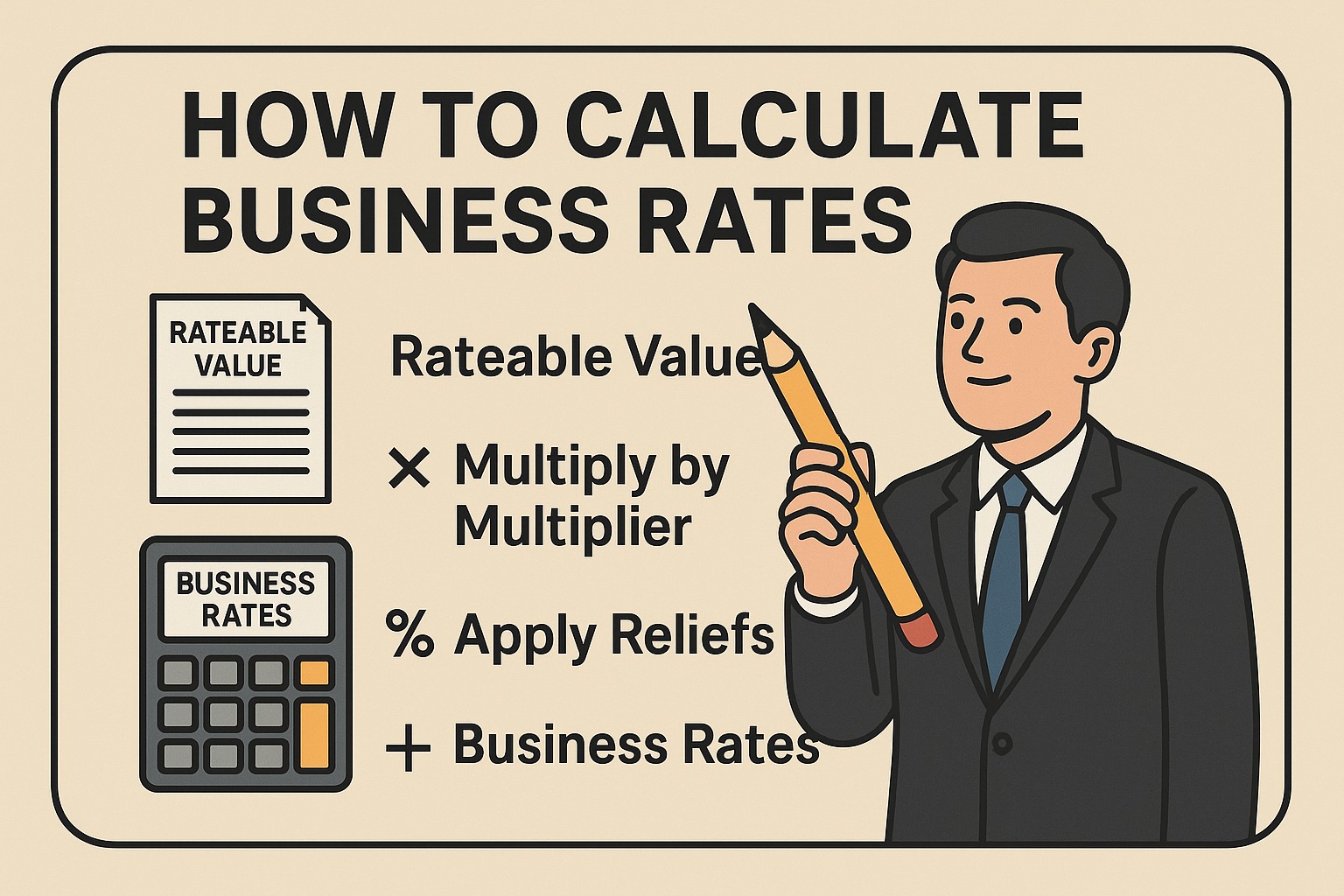

Step-by-Step: How to Calculate Business Rates

To calculate your business rates, follow these steps:

Step 1: Find Your Rateable Value

Use the VOA website to find your property’s rateable value.

Step 2: Choose the Correct Multiplier

Depending on your rateable value, use either the small business multiplier or the standard multiplier.

Step 3: Multiply RV by Multiplier

Multiply your rateable value by the correct multiplier. For example:

If your RV is £40,000 and you qualify for the small business multiplier:

£40,000 × 0.499 = £19,960

This is your annual business rates bill before reliefs.

Step 4: Apply Reliefs (If Eligible)

You may qualify for a reduction. Reliefs lower the amount you need to pay.

Types of Business Rate Relief

Small Business Rate Relief (SBRR)

If your property’s RV is less than £15,000, you may get up to 100% relief. Properties under £12,000 often receive full relief.

Charitable Rate Relief

Charities and community amateur sports clubs may receive up to 80% relief.

Rural Rate Relief

For properties in rural areas serving small populations.

Transitional Relief

Applies if your rates increase or decrease significantly after revaluation.

Retail, Hospitality, and Leisure Relief

Available to qualifying businesses in those sectors.

Empty Property Relief

No business rates for 3 months on empty properties (6 months for industrial buildings).

Hardship Relief and Discretionary Relief

Available in special circumstances through your local council.

Business Rates Across the UK

Business rates differ slightly depending on your region:

- England: Uses the multipliers mentioned above.

- Wales: Has its own system and multiplier.

- Scotland: Different reliefs and thresholds apply.

- Northern Ireland: Uses a regional rate and a district rate.

Understanding Revaluations

The VOA revalues all business properties periodically to reflect changes in the market. The most recent is Revaluation 2023. The next is planned for 2026.

This helps ensure that rateable values remain fair and reflect current market conditions.

How to Appeal Your Rateable Value

If you think your RV is too high, you can use the VOA’s Check and Challenge process. This allows you to:

- Check the details of your property.

- Challenge the rateable value with evidence.

If successful, your RV may be lowered, reducing your bill.

How to Pay Business Rates

Your local council will send you a bill each year, usually in March. Payment options include:

- A single annual payment

- Monthly instalments (up to 12 months)

If you’re struggling to pay, contact your local authority for business rates support.

Common Questions (FAQs)

What is the Uniform Business Rate (UBR)?

It is another term for the business rates multiplier.

Are all properties subject to business rates?

Most commercial properties are, but there are some exemptions (e.g., agricultural buildings).

Can I estimate my business rates before getting a bill?

Yes, you can use the VOA property search and a business rates calculator to estimate your bill.

What happens if I don’t pay on time?

You may incur penalties or be subject to legal enforcement. Always try to set up a payment schedule.

Final Thoughts

Learning how to calculate business rates is key to managing your business finances effectively. Start by finding your rateable value, apply the correct multiplier, and subtract any eligible reliefs.

Stay informed about updates like Revaluation 2026 and make use of local authority resources, including the business rates guidance and support services. Whether you’re in England, Wales, Scotland, or Northern Ireland, taking control of your business rates can lead to real financial savings.