Tesco Market Share: Understanding Its Growth and Market Position in 2025

An Overview of Tesco Market Share & Financial Performance

Tesco is a leader in the UK grocery market. It has maintained a strong position for years, thanks to its innovative strategies, digital transformation, and large market share. In this article, we’ll dive into Tesco’s market share, its key competitors, the strategies that keep it at the top, and the challenges it faces as it moves into 2025.

Tesco Market Share in 2025: A Snapshot

Tesco’s Growing Market Share

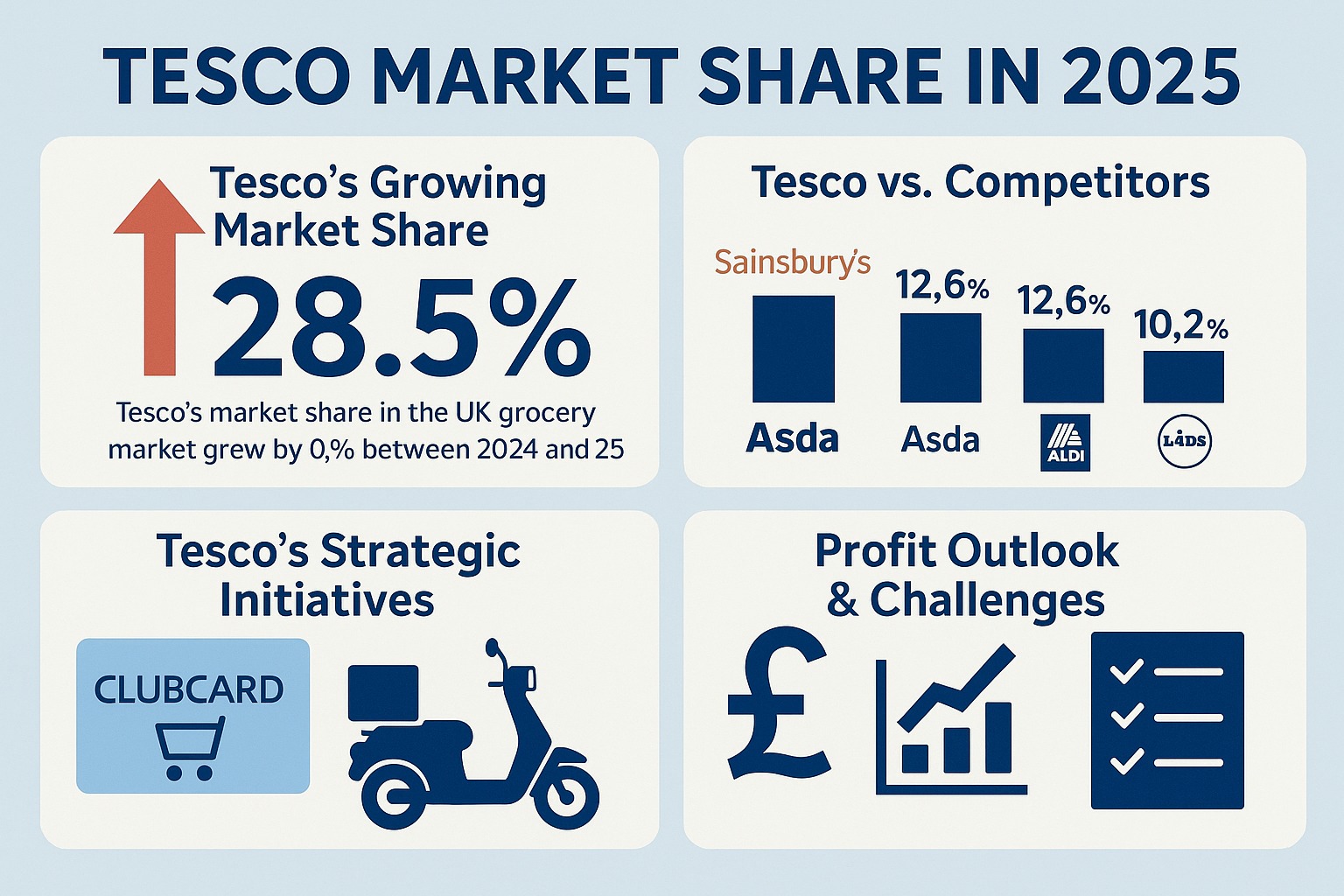

In 2025, Tesco holds 28.5% of the UK grocery market. This makes it the top supermarket in the country, ahead of its competitors. Even with fierce competition, Tesco continues to lead thanks to its focus on customer satisfaction and affordable pricing.

Between 2024 and 2025, Tesco’s market share grew by 0.7%. This growth is driven by the company’s ability to stay ahead of market trends, including its emphasis on both in-store and online shopping options.

Tesco’s Market Share Growth

Tesco’s market share has grown over the years, mainly because it keeps customers satisfied. The company’s success can be linked to its competitive pricing, strong product selection, and customer loyalty programs. As more people shop online, Tesco has embraced e-commerce and continues to lead the charge in the online grocery space.

With the rapid rise of online grocery shopping, Tesco’s market share in 2025 is expected to remain strong. The company’s commitment to innovation and meeting customer needs will help it hold its ground.

Competitors & Market Dynamics: How Tesco Stands Against the Rest

Tesco vs Sainsbury’s Market Share

Sainsbury’s is one of Tesco’s biggest competitors, with around 15.9% of the UK grocery market share. Although Tesco is the market leader, Sainsbury’s remains a key player, especially with its customer loyalty programs and focus on high-quality products. However, Tesco’s broader product range and more extensive store network keep it ahead.

Tesco vs Asda Market Share

Asda holds about 12.6% of the market share. While it has made gains, Tesco’s large selection of products and extensive online services keep it in a leading position. Tesco’s Clubcard Price Match and other loyalty incentives are key to maintaining its market share against competitors like Asda.

Tesco vs Aldi Market Share

Aldi has gained ground in the UK grocery market, holding 10.2% of the market share. Aldi’s strategy of offering low-priced items appeals to budget-conscious shoppers. However, Tesco’s diverse range of premium products and customer loyalty programs help it retain a strong market position.

Tesco vs Lidl Market Share

Lidl, like Aldi, has seen steady growth in the UK, currently holding 7.2% of the market share. Despite this, Tesco remains ahead due to its broader range of products, premium options, and loyalty offerings.

Tesco’s Strategic Initiatives: How the Company Plans to Grow

Tesco Clubcard & Promotions

Tesco’s Clubcard is one of the company’s most effective tools for maintaining market share. With over 23 million UK households enrolled, it offers discounts and promotions that attract repeat customers. The Clubcard Price Match and various Clubcard Promotions help Tesco stay competitive, offering customers the best value.

Tesco Whoosh Delivery & Online Growth

A key part of Tesco’s digital transformation is its Whoosh Delivery service. This rapid delivery option allows customers to order groceries online and have them delivered within hours. The popularity of online grocery shopping continues to rise, and Tesco is well-positioned to benefit from this shift.

The growth of Tesco’s online market share is also worth noting. The company’s online grocery sales have grown significantly, helping it capture a larger share of the e-commerce space. Tesco’s mobile app, with over 18 million users, also plays a key role in boosting online sales.

Digital Transformation and Innovation

Tesco’s digital transformation goes beyond online shopping. The company uses technology like artificial intelligence to improve supply chain management and enhance customer experiences. This ongoing investment in digital tools keeps Tesco ahead in the highly competitive retail market.

Profit Outlook & Challenges: What Lies Ahead for Tesco?

Tesco’s Profit Outlook in 2025

While Tesco remains the market leader, the company is facing challenges. Tesco has warned of a potential decline in profits for the fiscal year ending in February 2026. The rising costs of inflation, higher wages, and the Packaging Levy are all expected to impact profits.

The Impact of Rising Costs

The Packaging Levy and increased wages are putting financial pressure on Tesco. However, the company’s strategy of providing great value through its Clubcard program and promotions is helping offset some of these rising costs.

FAQs: Key Questions About Tesco Market Share

1. What is Tesco’s market share in the UK?

Tesco holds 28.5% of the UK grocery market, making it the leader in the sector.

2. How has Tesco’s market share changed between 2024 and 2025?

Tesco’s market share increased by 0.7% from 2024 to 2025, driven by customer loyalty programs and competitive pricing.

3. What are the key factors driving Tesco’s market share growth?

Tesco’s growth can be attributed to its Clubcard loyalty program, Whoosh Delivery service, and strong online presence.

4. How does Tesco compete with budget retailers like Aldi and Lidl?

Tesco competes by offering a wider product range, including premium items, and providing value through Clubcard rewards.

5. What challenges is Tesco facing?

Tesco is dealing with rising costs, including inflation, wages, and packaging levies, which are expected to impact profits in 2025.

Conclusion: Tesco’s Position in 2025

Tesco remains the dominant player in the UK grocery market, holding a 28.5% market share. The company’s success is built on strong customer loyalty programs, a broad product range, and a commitment to digital transformation. While rising costs and increased competition pose challenges, Tesco’s strategic initiatives should help it maintain its lead in the competitive UK grocery market.