Leeds Property Market Trends Investment Opportunities

The Leeds property market is thriving. It’s one of the fastest-growing cities in the UK. This growth fuels a dynamic housing market.

Leeds offers diverse real estate options. From modern apartments to traditional homes, there’s something for everyone. The city’s vibrant economy attracts many investors.

Infrastructure improvements are underway. Projects like the HS2 rail link promise to boost property values. This makes Leeds an attractive investment destination.

The rental market is robust. High demand from students and professionals keeps it lively. Leeds offers competitive yields for buy-to-let investors.

Looking ahead, Leeds property market trends suggest continued growth. The city council plans to deliver thousands of new homes by 2025. This aligns with the city’s strategic development goals.

Leeds is a key player in the UK’s real estate scene. Its strategic location and economic resilience make it a prime investment hub.

Overview of the Leeds Housing Market

Leeds is experiencing consistent growth in its housing market. This city in West Yorkshire is a vibrant hotspot for real estate. Investors see it as an appealing destination.

Demand for housing is high. A strong local economy and growing population fuel it. Leeds attracts professionals and students from all over the world.

The city’s property market is diverse. You can find everything from high-rise apartments to traditional Victorian houses. There’s something to suit various tastes and budgets.

Key factors driving the Leeds housing market include:

- Economic growth and stability

- Infrastructure developments like the HS2 rail project

- A diverse mix of property types

Leeds is not just about residential properties. The city has a thriving commercial real estate sector, too. This adds another layer of investment opportunities.

The Leeds City Council is proactive. It supports housing strategies aimed at meeting future demands. This includes planning for thousands of new homes by 2025.

Leeds offers a compelling mix of affordability and growth potential. Compared to London, property prices are lower, making Leeds appealing to investors. However, the city presents significant prospects for appreciation. This combination continues to attract interest from domestic and international investors alike.

Key Drivers of Leeds Property Market Trends

Several factors drive the dynamic property market in Leeds. These influences make the city a prominent real estate hub in the UK.

Firstly, the economic strength of Leeds cannot be overstated. A hub for financial services and digital industries, the city attracts a diverse workforce. This, in turn, boosts demand for housing significantly.

Moreover, the city’s education sector plays a crucial role. Numerous universities and colleges draw thousands of students annually. As a result, rental properties remain in high demand, especially near campuses.

In addition to economic and educational factors, infrastructure investments contribute heavily. Projects like the HS2 rail link enhance connectivity. This improvement increases the city’s appeal to residents and businesses alike.

Notably, urban regeneration projects are transforming old industrial areas. These projects include mixed-use developments and new amenities. They elevate property values and drive interest across various buyer segments.

Key drivers of the Leeds property market include:

- Economic and sectoral diversity

- Strong education sector presence

- Major infrastructure upgrades

- Urban regeneration initiatives

These drivers collectively shape the future of Leeds’ property market. They create a thriving environment for both residential and commercial investments. As the city continues to develop, these factors promise sustained growth and opportunity.

Recent Performance: Prices, Rents, and Demand

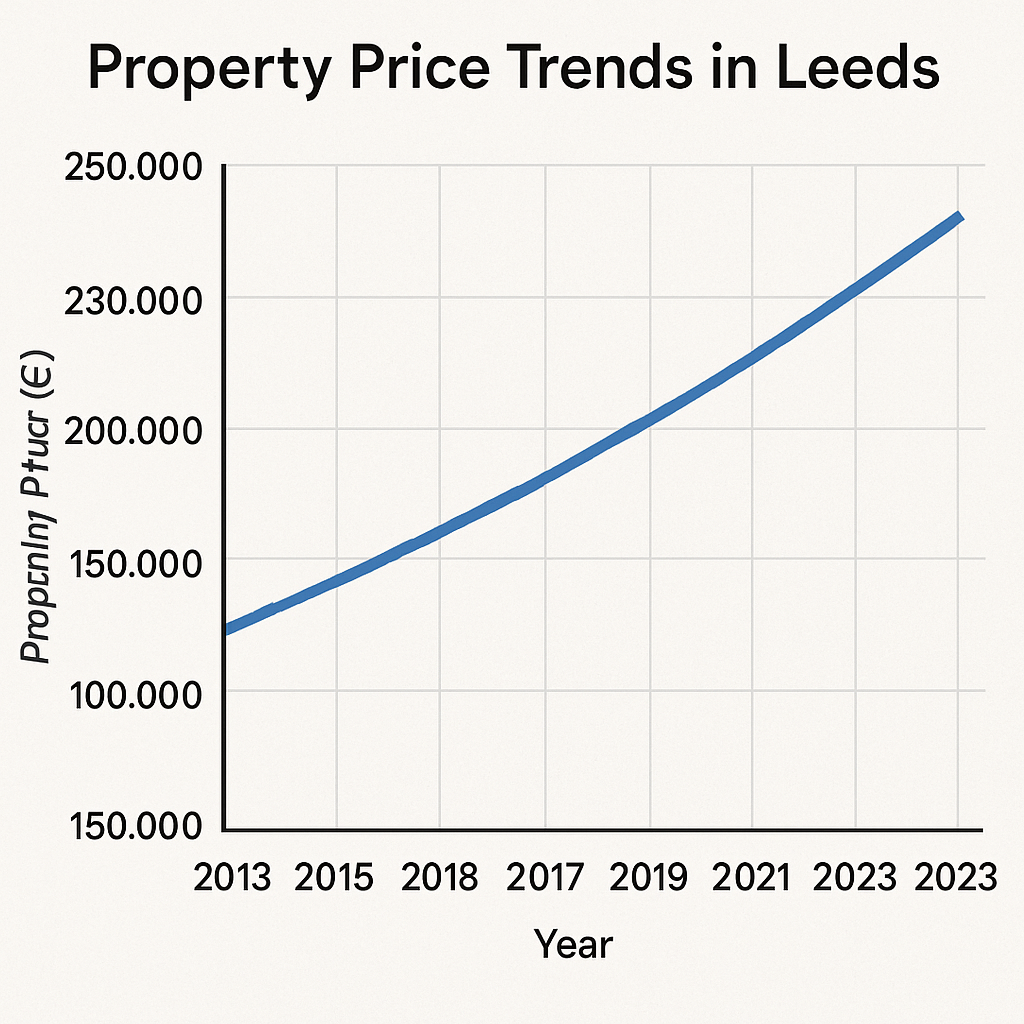

The Leeds housing market has shown remarkable resilience and growth in recent years. Property prices have steadily increased, reflecting strong demand.

Leeds offers diverse property types, from modern flats to traditional homes. The variety caters to a wide range of buyers and investors.

Over the past year, average home prices have climbed. This trend is fueled by the city’s vibrant economy and quality of life. Leeds continues to be an attractive option for both first-time buyers and seasoned investors.

Rents have also mirrored this upward trajectory. The robust rental market is driven by a high influx of students and young professionals. Leeds remains one of the top cities for buy-to-let investments due to competitive rental yields.

Demand for properties in Leeds remains strong due to several factors. These include economic growth, population influx, and improved infrastructure. As the city grows, more individuals seek accommodations, driving demand higher.

Recent market performance highlights:

- Steady increase in average property prices

- High rental yields and strong rental demand

Leeds’ recent property market performance is illustrated by continuing growth in both sales and lettings. Investors and homebuyers find attractive opportunities in the city.

With many key projects planned, the city’s real estate scene is expected to thrive. Enthusiastic buyers and investors can anticipate continued market momentum. Leeds seems set for sustained growth in the coming years.

Leeds Property Market Trends 2025: What to Expect

Looking ahead to 2025, Leeds is poised for sustained growth in its property market. The city’s strategic position and ongoing development projects position it as a significant investment location.

The Northern Powerhouse initiative continues to play a pivotal role. It aims to boost economic growth, thereby influencing property trends positively. Increased job creation and infrastructure advancements are expected to drive housing demand further.

Leeds’ infrastructure improvements, such as the HS2 rail project, are particularly noteworthy. These projects are anticipated to enhance connectivity, making Leeds even more appealing to commuters and businesses.

A shift towards suburban living has been noted, influenced by recent remote working trends. This change is likely to continue, with increased demand for family homes and properties offering more space.

Sustainability will be a key focus, with green developments gaining traction. Developers are increasingly incorporating eco-friendly designs, which appeal to environmentally-conscious buyers.

Anticipated trends forthe Leeds property market by 2025 include:

- Continued increase in property values

- Growth in suburban and eco-friendly housing demand

- Strengthened infrastructure and connectivity benefits

In summary, Leeds’ property market is set to thrive by 2025. The combination of strategic initiatives and infrastructure improvements underpins a positive outlook. This makes Leeds an attractive choice for real estate investment.

Investment Hotspots and Fast-Growing Areas

Leeds boasts several hotspots that stand out for investors. These areas offer promising opportunities with potential for high returns and sustained growth.

The South Bank area is undergoing significant transformation. This regeneration project is one of Europe’s largest and aims to create thousands of homes and jobs. It has already attracted significant interest from both domestic and international investors.

Kirkstall and Horsforth are other growing locations within Leeds. These areas are appealing due to their proximity to the city center and excellent transport links. They also offer a mix of residential options, from modern apartments to traditional homes.

Chapel Allerton is gaining popularity among young professionals. Known for its vibrant community, it offers a range of independent shops and dining options. Property values here have been rising steadily, making it a worthwhile area for investment.

Areas of investment focus include:

- South Bank regeneration

- Kirkstall and Horsforth for residential appeal

Growing interest hotspots:

- Chapel Allerton, with its vibrant lifestyle

- Suburban locations due to remote working trends

Each of these areas presents unique benefits and challenges. Investors should evaluate based on their strategic priorities and potential returns.

Buy-to-Let and Rental Market Opportunities

Leeds has established itself as a strong contender in the buy-to-let arena. This is driven by a growing student population and young professionals seeking rental accommodations.

Rental yields in Leeds are among the most competitive in the UK. Investors can expect attractive returns, especially in areas near universities or the city center. The robust demand provides a steady stream of potential tenants year-round.

The student market is a major force in Leeds’ rental scene. With universities like Leeds Beckett and the University of Leeds, the demand for rental properties remains high. Many students prefer living off-campus, boosting this segment of the market.

Buy-to-let investors often explore neighborhoods with high rental appeal. Areas like Headingley and Woodhouse, known for their vibrant atmospheres, are particularly popular. These areas are well-connected and have a lively social scene, appealing to young renters.

Key factors influencing buy-to-let opportunities include:

- High rental demand among students and professionals

- Competitive rental yields compared to other cities

- Popular rental districts such as Headingley and Woodhouse

Leeds offers a promising platform for buy-to-let investments, with several options suiting different investor profiles.

Regeneration, Infrastructure, and Future Developments

Leeds is experiencing a transformative wave of regeneration projects. These initiatives aim to elevate the city’s appeal and property market standing. The South Bank project is among the most ambitious, with plans to create a vibrant mixed-use district.

Infrastructure improvements are central to Leeds’ growth strategy. Enhancements like the HS2 rail project promise better connectivity, attracting both businesses and residents. Such developments are anticipated to boost property values significantly.

Future projects focus on expanding urban living options and enhancing public spaces. Leeds city center is set to gain more residential units, catering to diverse lifestyles. This aligns with growing urban living trends and demand for city-center conveniences.

The Leeds property market is poised to benefit from strategic investments. Key areas are being eyed for development, promising new opportunities for investors. These investments not only enhance market potential but also improve the quality of life.

Key regeneration and development highlights include:

- South Bank Project: A major mixed-use development

- HS2 Rail Project: Improved connectivity, enhancing property appeal

- Expansion of Urban Living: New residential units in the city center

Collectively, these initiatives set a promising horizon for Leeds, underscoring its position as a burgeoning real estate hub.

Sustainability and Emerging Trends in Leeds Real Estate

Sustainability is increasingly shaping the Leeds real estate market. Developers are keen on integrating eco-friendly practices into new projects, responding to rising environmental concerns.

This shift is driving growth in green building technologies and sustainable materials.

Emerging trends also show a keen interest in energy-efficient homes. Buyers and renters are prioritizing properties with lower environmental footprints. This preference not only enhances property desirability but also reduces utility costs.

The demand for sustainable housing aligns with regulatory advancements. Government policies encourage green initiatives, bolstering investment in eco-conscious real estate. These regulations are pivotal in guiding the market towards a more sustainable future.

Key trends driving sustainability in Leeds real estate:

- Eco-friendly development practices

- Increasing demand for energy-efficient homes

- Government support for green initiatives

These trends underscore a commitment to sustainability, marking a significant evolution in Leeds’ property market dynamics.

Risks, Challenges, and How to Navigate Them

The Leeds property market, while promising, is not without risks. Economic fluctuations can impact property values and demand. Investors need to stay informed on economic conditions.

Regulatory changes are another potential challenge. New policies can affect taxes, rental regulations, and development approvals. Understanding these policies is crucial for minimizing risks.

Market competition is fierce in Leeds. Savvy investors conduct thorough research to identify unique opportunities.

Strategies to mitigate risks include:

- Monitoring economic conditions

- Staying updated on regulatory changes

- Conducting comprehensive market research

These steps help investors make informed decisions and navigate the complex Leeds real estate landscape.

Conclusion: Is Now the Time to Invest in Leeds?

The Leeds property market offers robust potential with its growth prospects and diverse opportunities. Investing now could yield significant returns as the market continues to develop.