Closing Cost Assistance Can Save Your First Home Deal—Act Fast!

Plano, Texas – Jan 1, 2026: Buying your first home can feel impossible right now. Prices are high, the rates feel scary, and cash feels tight. That is why closing cost assistance from Dream Home Mortgage matters more than ever. This is not a long-term offer as it’s a limited pool of money that can run out at any moment. If you wait, you may lose your chance forever. Right now, Dream Home Mortgage is helping first time home buyers access a powerful down payment assistance program through the HELP Program. This is real money that comes free from any payback or hidden cost. Who would give up such a golden opportunity? And once it is gone, it is gone.

Get Up to $25,000 in Free Help for Your First Home

This First-time home buyer assistance can give you up to $25,000 in Texas or New Mexico. Buyers in Arkansas, Louisiana, or Mississippi can receive up to $20,000. This money can be used for down payment assistance for first-time buyers and closing cost assistance. Best of all, you never have to pay it back. There is a strict limit. Dream Home Mortgage has a $150,000 member cap, which means only a small number of buyers can be helped. Funds are given on a first-come, first-served basis. The program ends on December 31, 2026, or sooner if the money runs out. And it is moving fast. This program officially starts January 2, 2026, but waiting even a few days could cost you everything.

Why This Closing Cost Assistance Is So Urgent?

Most first time home buyers lose deals because of cash needed at closing. That is where this closing cost assistance changes everything. It can lower what you need to bring to the table and help you move forward now instead of years later. Every day you wait, other buyers are applying. Once the funds are used, no extensions are given. Moreover, you will get no exceptions. Therefore, missing this window could delay homeownership for years.

Apply For This Grant from Dream Home Mortgage

Applying on your own can be confusing and slow. That is why Dream Home Mortgage handles the hard part for you. Their team moves fast because speed matters here.

Here is how they help you secure the grant before it disappears:

- They check if you qualify for the down payment assistance program

- Their team prepares and submits all paperwork correctly and on time

- DHM sends your application directly to the HELP Program

- They work to lock in your grant before funds run out

You don’t have to do the guess work, nor chase answers as you can move forward with clarity and speed. Apply Now!

Extra Benefits You Only Get with DHM

This is not just about one grant. Dream Home Mortgage offers real flexibility when others say no:

- Rates that match or beat competitors

- Loans for buyers with low credit scores (as low as 580)

- Options for ITIN borrowers, EAD cards, and H1-B visas

- High debt-to-income ratios accepted

- Low closing costs with no last-minute surprises

- Fast approvals, sometimes in as little as 14 days

They also offer FHA, Conventional, Jumbo, Reverse, Construction, and Cash-Out loans, all backed by over 27 years of experience.

Act Now or Miss Out for Good

This is not a “think about it later” moment. This closing cost assistance and first-time home buyer assistance is limited, capped, and already being claimed. Waiting could mean losing up to $25,000 that you never have to repay. Dream Home Mortgage is ready to help you secure this grant before it disappears and turn your goal of homeownership into reality today. Your first home may be closer than you think—but only if action is taken now.

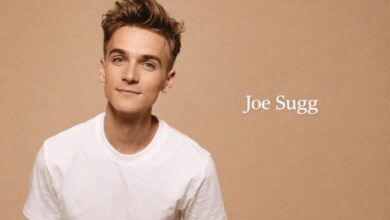

As CEO Hussein Panjwani explains,

“This is a rare opportunity for first-time buyers to get thousands in assistance that never has to be repaid. Funds are limited, and once they’re gone, they’re gone—so acting now can make the difference between getting your dream home or waiting years.”

All you have to do is book their one-on-one free consultation session before the funds run out!

About Dream Home Mortgage

Dream Home Mortgage (DHM), a division of Brazos National Bank, has been serving clients nationwide. DHM provides personalized mortgage solutions and are known for their transparency, competitive rates, and hands-on guidance. Their team of expert mortgage brokers helps buyers move forward with confidence. So, you can count on them to get the ball rolling and secure these funds for you before they run out.

Media Contact:

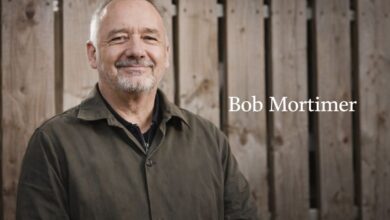

Hussein Panjwani

CEO, Dream Home Mortgage

📞 (972) 245-5626

🌐 https://dreamhomemortgage.com

READ ALSO: New Jersey Car Accident Laws Every Driver Should Know